Cover photo by Zac Ong

The contentious nature of policing causes many officers to look for an exit, even if it comes before full retirement age. Working in law enforcement can feel like scenes from Ayn Rand’s Atlas Shrugged when productive workers mysteriously began disappearing from the workforce.

One day your shiftmates are in the showup briefing, joking and recounting tales of the worst call ever. The next day, you see a Twitter photo of a particularly charismatic sheriff swearing in your former shiftmate into his department. Others simply pop smoke and leave law enforcement entirely.

Financially, hanging up the duty belt isn’t easy. You probably exited the private sector in your 20’s or 30’s to start a career in law enforcement. Now in your 30’s, 40’s and 50’s, it’s tough to imagine starting from the bottom in the private sector, far behind your peers in career track and retirement readiness.

You also know its a difficult choice because you’ve spent years responding to calls in retirement homes and public housing. You’ve seen too many penniless old-timers sitting in dim kitchens staring at refrigerators stocked with SPAM and Hamm’s Light. Grandkids send Christmas cards because they won’t be spending the holidays there in person.

The scary thing is that you realize those Ghosts of Christmas Future used to work a job just like the one you’re working right now. Bad luck, poor financial choices, or a combination of both has left them one social security check away from destitution.

“I’m not going down that road,” you say to yourself. But even if you stay with policing until full retirement, will your pension meet your financial needs? Will the pension provide you with sufficient income security, protection from inflation, and liquidity for dealing with a major lifestyle change or illness?

While you can’t control conditions at work, you can control your readiness for an exit from work. One important lever you control is your contributions to a 457(b) deferred compensation plan. A 457(b) plan is the public sector version of the private sector’s 401(k).

Why Contribute to a Deferred Compensation Plan?

Diversification – “I don’t need to contribute to a 457 – I have a pension.” Yes, but how secure is your pension? Have you watched its funding ratio drift downwards over the course of your career while its funding period to amortize liabilities climbed higher?

If you’re 45 and expect to live to 90, you’ve got to hope that investment decisions by many generations of future pension managers won’t cause reductions in your benefits. Given the troubles defined benefit pensions are facing today, both financially and politically, that’s a dicey proposition.

How the 457 can help – It can takes decades of saving money in a deferred comp or individual retirement accounts (IRA) to build up a balance that can provide you with decent level of retirement security. But once all of your retirement eggs are no longer in one basket, the risk of pension problems causing you sleepless nights in old age is reduced because you are no longer reliant on just a pension alone.

Inflation Hedge – “My pension will cover my thrifty lifestyle.” Police pensions often turn to cutting cost of living adjustments (COLAs) in order to fight against underfunding. So what happens when a retiree goes years or decades without a COLA?

I was interested in seeing how this idea held up over time, so I went to a retired police officers meeting to talk with retirees about it. I asked people who were in different decades of their retirement if their pension alone was meeting their needs.

The complaint that I heard from everyone I spoke with was the ongoing lack of an annual COLA. U.S. inflation has averaged just shy of 2% per year over the last decade. If a retiree was receiving a $4,000 monthly benefit in 2008, they are receiving that same $4,000 today. Living a thrifty lifestyle on $4,000 per month may have been easy in 2008. But $4,000 does not buy as much in 2018, and will buy even less in 2028 or 2038.

What if you retired today on a $6,000 per month pension? Pretty cool, right? However, without a COLA, how will that hold up over time? Here’s a look at how a 2% inflation rate would impact your purchasing power.

Without a cost of living adjustment to keep up with inflation, pension benefits will lose purchasing power over time.

As you can see in the chart above, if you retire at 50 on $6,000 per month, you can afford a decent lifestyle, a house in the quiet suburbs, some good meals here and there, and at least an early 2000’s Corvette. By the time you’re 60 your purchasing power is down to around $5,000 per month in today’s dollars without a COLA. Nothing to panic over, but belt-tightening is necessary.

By 70, your knees need replacing, your Corvette is rusting, and you’re wishing you took one more promotion exam. On a $4,000 per month fixed budget, tough choices will be made. At 80, you’re nearing half the purchasing power you had when you started retirement. $39,000 per year and Medicare won’t buy much more than a single bedroom apartment, a library card, and bus tickets. If you live into your 90’s, you’re clipping coupons for deals on SPAM and Hamm’s Light. You’d better have some generous children or good friends to take care of you, because at that point your pension won’t.

How a 457 can help – With proper management and controlled withdrawals, your 457 balance can last through your retirement. This can help provide you with steadily-growing extra income if the purchasing power of your pension doesn’t keep up.

Liquidity – “My house, car, and boat are paid off, so I won’t need extra money.” I keep telling my wife that when I retire and am no longer subject to department policies (or norms of decency), I’m going to grow a mullet haircut. Not a “ha ha” mullet, but an “oh, damn” European soccer-looking mullet. The kind of mullet that gets red-carded and thrown out of games. But a dude with a mullet behind the wheel of a current year ZR1 Corvette is held to a different esteem by society than a dude with a mullet driving a late 80’s Stingray with a treble-heavy tape deck and fading paint.

Have you ever spent years saving up for something you wanted, like a house, college tuition, a stake in a business venture, or a down payment for a dream car, because you didn’t have money available? Without money in a liquid account, you’ll face that same problem in your retirement years. Unlike your earlier years when you received an annual raise or could just work overtime, saving up money on a fixed income, especially without a COLA, will be tougher, if not impossible. Better find your old Kriss Kross cassettes because 80’s sports cars don’t have bluetooth.

Even if you don’t need extra money now, that doesn’t mean you won’t need it in the future. Life changes. Go to a retiree meeting, talk with people about what life after policing is like, and you’ll see what your life may look like some day. Kid-free and happy in your 30’s? Maybe you’ll want to foster kids or adopt later in life. Love roughing it on low cost camping trips now? You might want to join your friends on scenic globe-trotting trips in your golden years. Fit and healthy today? That doesn’t mean you won’t need money for new hips, knees, and other ailments as you age.

How a 457 can help – By contributing to a 457 plan, you could have a pool of money available to pay unexpected health, lifestyle, and other major expenses that come along in retirement. Plus, by choosing the Roth option, your distributions and earnings could be income tax-free.

How to Get Started with a 457(b) Plan

Get Registered – If you work for the City of Austin and are interested in contributing to a deferred comp account, head over to the City’s deferred comp website to login or register.

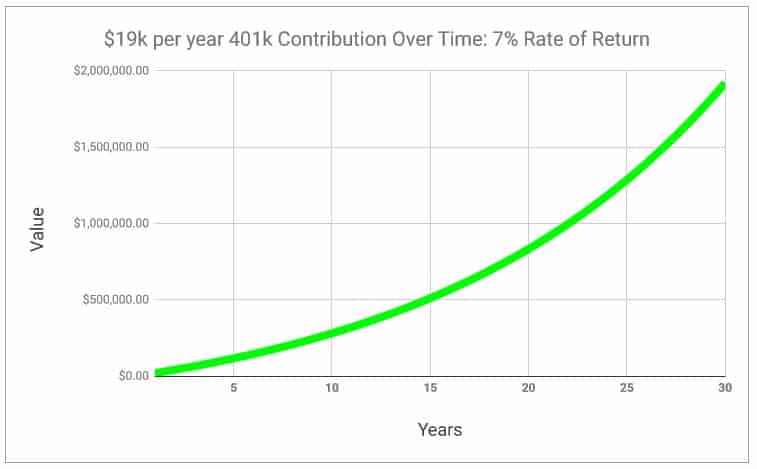

Choose a Contribution Amount – How much do you need to save for retirement? That depends on what balance you think you need at retirement. If you want to swing for the fence and contribute the $18,500 maximum amount over the course of your career, as the graph above shows, you could reach $1 million at around 24 years. That would buy you a lot of freedom to live your retirement years however you want.

Stick With It – Your paycheck, household expenses, and financial markets will go up and down over time, but stay with investing for the long haul. Whether you contribute $100 per month or the maximum amount, either way you will be better off at any stage in your life than if you contributed nothing at all.