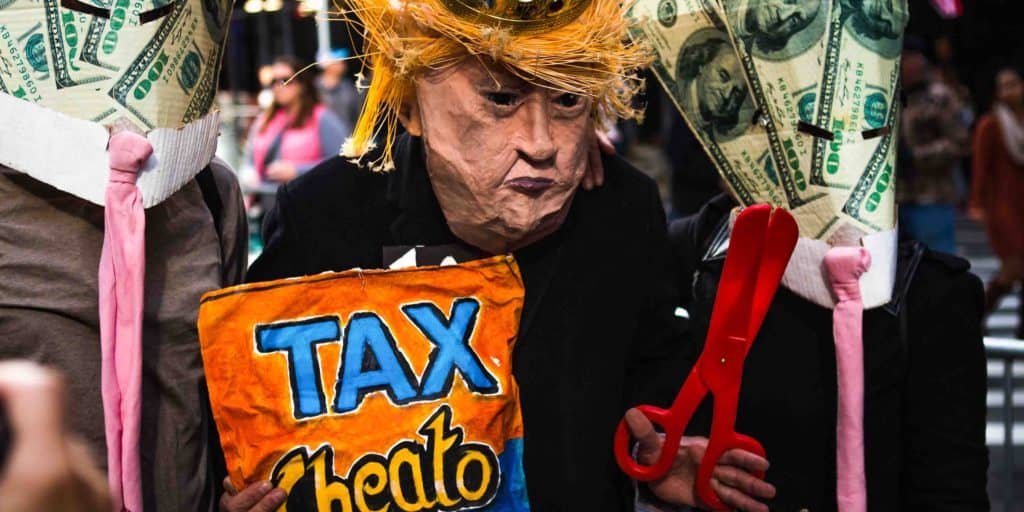

Some schmuck whining about the rich. Think he contributes to his IRA? Photo by Emma Udell, CC0.

Debate over the “wealth gap” is frequently an uninformed discussion about a useless distraction. Most often it’s written by broke college grads who would never dream of reading Ayn Rand, Zig Ziglar, or Dave Ramsey. A Google search of the term “wealth gap” brings up 5.9 million results of people whining about the gap, making excuses for why iPhone owners have no money, and figuring out why it’s someone else’s fault.

At worse, the wealth gap is a story that politicians and journalists use to grab your emotions and turn you into a tool for their own political and career purposes. Think votes, view counts, advertising revenue, etc.

Bernie Sanders made himself a presidential candidate this way. Look at the cast of news anchors on MSNBC – they’re the world’s greatest pity-party throwers. They went from nothing to having their own television shows by whipping up sound and fury over narratives like the wealth gap. But have they solved your problems? Have they made a difference in the wealth gap? Did Hugo Chavez’s socialist revolution make Venezuela better off?

Nope, nope, and Good Lord, no! Venezuelans are now eating dogs in the street to survive because of socialism. The failure of socialist promises and efforts are as predictable as clockwork.

People said President Obama would fix everything, take money from the rich, and give it to you to reduce inequality. But did he fix the wealth gap? Did he reduce inequality?

Nope, and nope. What a surprise, right? Again, like clockwork.

Sidenote: I actually liked Obama, think he’s a decent dude, and am disappointed, but not surprised, by his inability to change things.

So if news pundits, bloggers, and politicos can’t fix the wealth gap, then how can it be solved?

Here’s the lowdown on the wealth gap – you caused it, you are continuing to make it worse, and only you can change that.

What is wealth?

To talk about why the wealth gap exists, let’s talk about what wealth is. Simply put, it’s a desirable lifestyle and enough money to sustain it. How much money does it take to be wealthy? That depends on your lifestyle, not a particular dollar amount. If you’re happy living in a double-wide trailer next to a river, sipping Coors Light, eating a burger, and watching the kids play in the yard, then you don’t need much money to be wealthy. Accumulate enough money to maintain your trailer and put food in your kids’ stomachs. Congratulations, you have an abundance of the lifestyle you desire. You are wealthy.

If you want to do nothing less than globe-trot in a Learjet, then you’ll need tens of millions of dollars, if not hundreds of millions, to pay for that lifestyle.

But if you’re like most people, you probably want a house with no mortgage and enough money to do what you love without worrying about paying bills.

You need money to achieve this lifestyle, and you’d love to see a million dollars on your net worth spreadsheet. <– Go ahead, click that link. You’ll thank me in a few years.

But you’re nowhere close to $1 million in net worth, or even a hundred thousand for that matter. Maybe you’re one lost paycheck and two months’ worth of dwindling savings away from moving in with your parents. I know that feeling.

“Why can’t I get ahead,” you wonder. You ask Google what wealth is and start seeing articles about how rich people have all the money, that Bernie is promising to take money from them and give it to you, and that the wealth gap is preventing you from living the American Dream. So who is to blame for this situation?

You are.

You created the wealth gap

Your decision to spend your discretionary income on trendy, glittery stuff rather than invest it in your 401k, individual retirement account (IRA), real estate, or personal business is why the wealth gap exists. Pick any billionaire you can think of. How did they get wealthy? Has Steve Jobs ever taken money out of your purse and handed you an iPhone X? Did Dr Dre throw Beats headphones on your ears and take your wallet? Have Sony shareholders put a lien on your paycheck and jammed a Playstation under your TV? Did Chevrolet coerce you into buying a new Silverado instead of a used one?

No, no, no, and no.

You made other people billionaires and millionaires by willingly buying their products and services. They didn’t wave a magic corporate wand over the country and vacuum up billions of dollars from the poor and downtrodden.

You gave them every dollar they have, and you enjoyed doing it.

That smell of a $1,000 iPhone coming out its box is just unbeatable, and you’ll do it again next year when you’re eligible for an upgrade. Every person camping down the street for days outside an Apple store is part of the wealth gap problem. They actually spend days camping in the cold to throw their money at billionaires.

You and millions of people like you made yourselves poor and broke by using your money to build other people’s wealth rather than your own.

How did this happen? Yesterday you grabbed a $6 Starbucks drink instead of a $6 issue of Money Magazine. Today you bought a trendy $50 shirt instead of a $50 index fund share. Tomorrow and for many months to come you’ll pay top dollar for ATT Fiber internet so you can get 1GB of internet speed, even though your new Apple MacBook’s WiFi modem limits you to the same 200MB transfer rates that lower-priced services provide. Go ahead, test your bandwidth. I bet it’s nowhere near what you’re paying for. Downgrade your service and invest the difference.

Ninety-nine percent of your money decisions are geared towards spending for present consumption rather than investing for the future. Now multiply your spending over a few hundred million other Americans who spend the same way. It should be clear why some people have a truckload of wealth and most have none.

Go ahead, try to find one, just one coworker who puts the maximum amount allowed, $19,000 in 2019, into their 401k. I bet it’s about three out of 100 people, if you find anyone at all. Two out of three people don’t even contribute to their 401k.

But ask around and see how many people have a $500 per month car payment and a $1000 per month entertainment and shopping budget. I bet quite a few, if not the majority. They choose to spend $19k per year on stuff they don’t need rather than maxing out their 401k.

They, just like you, built the wealth gap. But you can fix that.

How you can fix the wealth gap

How do you fix the wealth gap? First, by fixing your mindset. I strongly recommend Dave Ramsey’s podcast if you’re new to this. His advice is a good starting place. Scott Trench nailed it in his Bigger Pockets podcast. <– If you only listen to one podcast about money in your life, listen to that one. Without the right mindset to not only earn money, but keep it and invest it once you have it, then you’re wasting your time.

Second, by changing your money habits, starting with years of boring investing. Yes, years and years of seeing a $1300 bi-weekly paycheck rather than a $2000 paycheck because you’re deferring the max amount towards your 401k. Years of spending a sweet vacation budget on a $5500 Roth IRA contribution. Paying that extra $200 worth of beer money towards principal on your mortgage every month when the “pay minimum due” button is screaming at you. Throwing an extra $100 worth of your clothing budget down your student loan rabbit hole, never to be seen again, so you can finally get free of your college debt. Rocking a flip phone like a boss and paying $10 per month for an extra phone line on your parents’ plan rather than $130 for a smartphone on your individual plan.

Third, stay the course, year after year. Frugality sucks, right? But if solving the wealth gap matters to you, this is how it’s done. These are the solutions. These are the daily tactics and long-term strategic decisions wealthy people made throughout their lives to get where they are. This is how people grow wealthy: one invested dollar at a time.

Give it some time and one day you’ll wake up the wealthy index fund shareholder that your still-poor friends are now whining about.

If you’re tired of being constantly, stop listening to other broke people telling you The Man’s oppressive wealth gap is holding you down. Don’t cry to the internet about your poor, basic life after you buy Starbucks and a new pair of UGG boots instead of a mutual fund. The Man and the wealth gap are not the problem. Your own money habits are.

Only you have the power to change that.

Jump over to the Facebook post and tell me why I’m wrong.